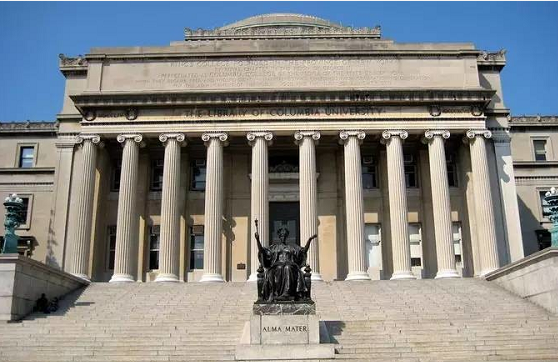

科研导师:哥伦比亚大学金融工程导师

科研地点:哥伦比亚大学科研组会议室

科研主题:风险投资和私募股权投资

科研亮点

1. 进入美国名校实验室/科研组,接触尖端科学

科研经历是美国名校申请的基石,顶级名校的科研项目是对学生有能力完成名校学业最好的证明;

2. 师从导师开展实验/科研

高层次的人脉和校友关系,与学生为伍的人是诺贝尔奖获得者、美国科学院院士、教授、名校博士、硕士,学生将体验到世界最顶级学术专家们的思想和气质;

3. 获得导师推荐信和科研证书

学生在科研结束时可以获得名校导师的推荐信,大大助力未来的留学申请;

4. 全天候专业英语环境,迅速提升专业水平

提升沟通和专业英语水平,提升专业知识和能力,用实践使学生的理论知识更加具体形象;

5. 高含金量收获助力未来留学深造及就业

在名校导师指导下的科研过程将帮助学生明确自身发展方向,不断深化对于美国学界的了解与认同,帮助参与学生及家长明确未来的学校及专业申请方向;从而更好的明确留学的目的与意义,摆脱盲目,获得真知;

科研目的

一、哥大科研组亲自辅导学生做学术科研,获得哥大导师的推荐信以及科研证书;

二、积累资深人脉,科研组的成员未来1-3年均为各大美国名校教授或世界500强企业精英,丰富了申请时所需的CV/ PS履历;

三、导师通过为期4周的科研帮助学生更快融入顶级名校校园文化;

四、全面了解金融工程师的职业人生;

五、你的Common App里的EC-Academic部分、大Essay和Why,你可以大做文章了。

科研计划

Who should take this research: Students seeking any of the three goals below would benefit from taking this research.

1. If you are interested in working for a venture capital organization at some point in your career.

2. If you expect to work alongside venture-capitalists either as an entrepreneur or investment bankers.

3. If you expect to work as money manager who would be investing in such funds.

Module 1: Fundraising

This module examines how VC funds are raised and structured. These funds often have complex features, and the legal issues involved are frequently arcane. But the structure of VC funds have a profound effect on the behavior of venture capital investors. Consequently, it is as important for the entrepreneur raising such capital to understand these issues as it is for a partner in a fund. The module will seek not only to understand the features of venture capital funds and the actors in the fund-raising process, but also to analyze them.

……

……

Module 3: Exiting

The third module of the research examines the process through which VC investors exit their investments. Successful exits are critical to insuring attractive returns for investors and, in turn, to raising additional capital. But venture capitalists concerns about exiting investments and their behavior during the exiting process itself can some- times lead to severe problems for entrepreneurs.

……

Module 4: Corporate Venture Capital

In this module we would examine how the Venture Capital model of supporting innovation has been adopted by large corporations. This model is usually referred to as Corporate Venture Capital. Many large corporation have tried to emulate the VC model to foster innovations. However the challenges and rewards of corporate venture capital are very different than those of a traditional VC fund. This module would explore some of these issues.

……

选拔流程

1. 提交报名表;

2. 科研组择优面试;

3. 面试通过后,发送录取确认书;

4. 协调机票、接机、住宿;

5. 赴美开始科研;

6. 获得导师推荐信,科研证书,丰富的CV、PS履历;

科研时间

时间:暑假或寒假,每期时间长度为3—4周;

(针对美高学生假期只有2周的情况,可选2周实地+2周远程,确保科研收获)

具体情况根据学生面试情况由美方进行调整;

报名后安排校方面试,面试前辅导学生阅读1篇专业论文;